You can also listen this article.

Why are property prices rising so fast in North Cyprus?

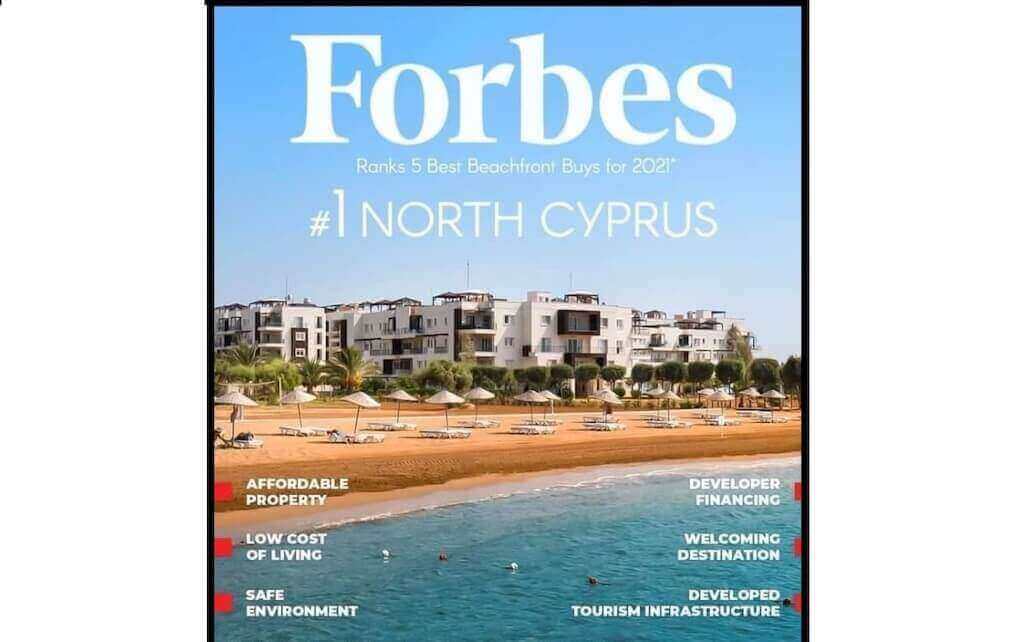

North Cyprus is booming! As a result of great international publicity (including Forbes investment magazine reviews), new nationalities are choosing to make the TRNC their home – and the world financial situation is also pushing up building costs. As a result, prices are rising and you need to be a cash buyer to secure one of the limited supply of key ready properties. This has understandably caused disappointment to some of our property seekers.

At North Cyprus International we have worked tirelessly for 19 years to match as many of our enquirers as possible with suitable homes in the TRNC. Owing to the recent price rises we are now sometimes unable to match buyers with exactly what is needed. We hope that this article will give you a realistic overview of current prices, in order to save you disappointment and wasted time. Please do call us at any time in the UK or Cyprus to discuss your search on +44 207 112 8086 or +90 548 861 0600. We may be able to make alternative suggestions which better fit your budget.

Who is buying property in North Cyprus?

Historically, British buyers were the most numerous in the TRNC. However, you may have seen the Forbes magazine articles over the last couple of years, which have voted North Cyprus one of the top beachfront property investment areas in the world. That has led to the North Cyprus property market being opened up to new nationalities (especially Scandinavians, Germans, as well as Russians, Ukranians and those from the Middle East) who had not perhaps previously considered making a TRNC villa or apartment purchase. With the North Cyprus residency costs also relatively easy for British (now non-EU) compared to EU destinations, this has also increased demand from all Non EU passport holders.

Be realistic about 2023 North Cyprus property prices

With such demand, key ready resale properties are in shorter supply and prices of both resales and new build properties have risen significantly. This of course causes disappointment to those who have been saving up – including many British buyers whose average salary is lower than in some EU countries. Prices of the key ready “resales” (pre owned) properties are rising in tandem with the higher priced new build properties, whose prices are also rising due to increased building costs due to the world financial markets.

What can you afford to buy in North Cyprus?

Let’s look on the bright side! Here is a list of our realistic appraisal of key ready, resale property (pre owned property) starting prices for the different types of properties (with title deeds and paperwork in order). Please note, these are starting prices only.

If you can’t now afford what you previously hoped to buy – it might just be necessary to readjust your expectations. For example, if previously you had hoped for a detached villa with own pool, perhaps you can have a villa or town house with a shared pool? Or even a large ground floor apartment?

There may occasionally be genuine bargains for quick sale, and many will be substantially more than this. Factors affecting price are: location, views, closeness to the sea, age of property, condition of property, type of title deed, facilities and obviously furnishings etc.

This situation is compounded by the fact that as it’s a seller’s market, most sellers will not accept offers from anyone needing a loan or mortgage as they will wait for a cash buyer (see section below on loans/mortgages).

2023 RESALE (PRE-OWNED) STARTING PROPERTY PRICES

An overview of villa, town house and apartment starting prices this spring (May 2023).

Apartment starting prices

One bedroom (in short supply as few were built 10-15 years ago) £60,000

Two bedroom – £80,000.

Three bedroom – £100,000.

Town house/terraced house starting prices (usually with shared pool, may have small private garden).

Two-bedroom town house – £140,000.

Three-bedroom town house – £150,000.

Detached villa starting prices

2-3 bedroom without pool -£165,000.

2-3 bedroom with pool -£185,000.

Please allow extra funds for the costs of buying.

Are there still cheap properties in North Cyprus?

Although there are less popular and more remote areas (such as the Karpaz) where property is still much cheaper, be careful if you find a significantly cheaper property online, as a low price can indicate a problem with the paperwork. Never part with any deposit money until you have had your North Cyprus lawyer check the legalities.

Do be aware that owing to the fast-moving market, some properties currently listed on the property portals such as Rightmove are out of date or sold. This can give a misleading picture and set your expectations a little too low.

Can I get a loan or mortgage to buy a resale (pre owned) property in North Cyprus?

If you are not a cash buyer, you may be seeking a resale (pre owned) property with a mortgage or loan. Although theoretically you could apply for a 50% North Cyprus bank mortgage on a resale with an individual (not shared) title deed, in practice the sellers will not accept an offer from anyone who is not a cash buyer unless you are Turkish Cypriot and already have a loan agreed in principle with a local bank (loans for locals come through more quickly – but can take up up to 18 months to come through for overseas buyers).

If you are buying an under construction or off plan new build property, you may be able to get a loan from the developer, but please note that you will pay significantly more than the starting prices above for a new build property.

What about the future?

The government has recently introduced higher Title Deed Transfer taxes partly to stop prices rising further. We have yet to see what effect this will have.

We feel that despite the rises, resale (pre-owned) property prices are unlikely to fall, and that they still represent a good investment due to lack of supply and the fact that they are cheaper than the same size of new build property.

If you have any questions about buying a property in North Cyprus, please do contact us.