New 100% Spanish Property Tax plans have been announced by the Spanish Government. If passed, these will apply to all non-EU overseas property buyers. British and other non-EU property seekers are therefore now rushing to secure the best property deals in North Cyprus, the perfect and much more affordable destination for their second homes in the Mediterranean.

The BBC’s recent article entitled “Spain plans 100% tax for homes bought by non-EU residents”: reports that many buyers are now considering Cyprus instead with the proposal making them think again about buying in Spain.

“Spain is planning to impose a tax of up to 100% on the value of properties bought by non-residents from countries outside the EU, such as the UK.

Announcing the move, Prime Minister Pedro Sánchez said the “unprecedented” measure was necessary to meet the country’s housing emergency”

Whilst the measure has not yet been passed, many British and other non-EU overseas property buyers are putting their Spanish property buying plans on hold and choosing to purchase property in locations like North Cyprus instead.

WHY CHOOSE NORTH CYPRUS PROPERTY OVER SPAIN?

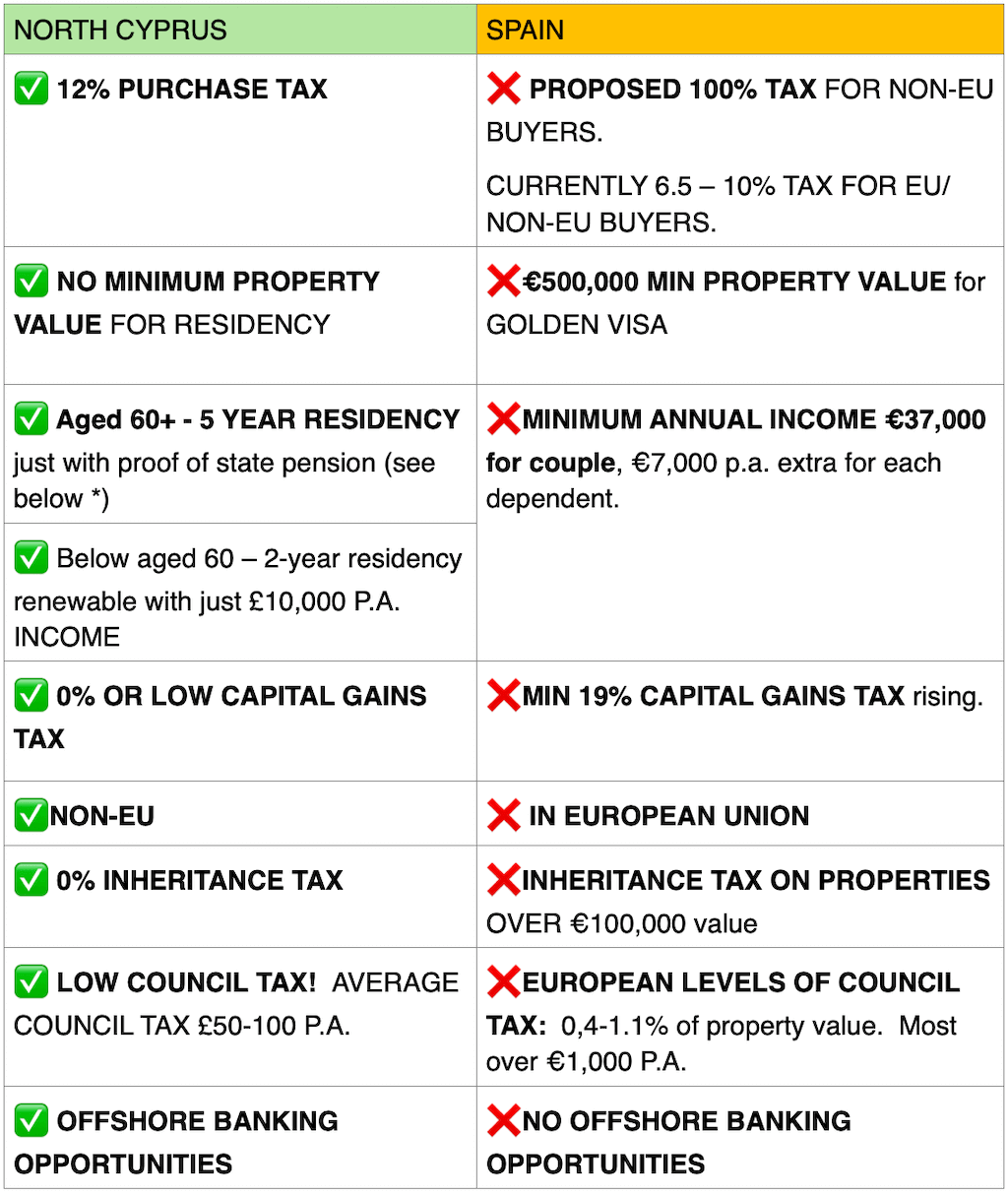

Even if the proposed 100% property tax in Spain is not passed into law, there are a huge number of existing benefits to buying property in Non-EU North Cyprus over Spain .

These include: No minimum property investment value for residency, low-income requirements for residency, low Council Tax, 0% inheritance tax, low or 0% capital gains tax and great offshore banking opportunities. In addition, 5-year residency visa exemptions are granted to British retirees who own a property.

*The 5-year residency visa exemption for retirees on state pensions is currently only available for British pensioners. Non British pensioners can still obtain residency easily once they are property owners.

WHY CHOOSE NORTH CYPRUS OVER SOUTH CYPRUS?

If you have decided against buying in Spain and are looking instead at Cyprus – you have the choice between the Turkish Cypriot North or the Greek Cypriot South. The North of Cyprus (TRNC) is not in the EU and the South of Cyprus (Republic of Cyprus) is an EU member.

The benefits of choosing Northern Cyprus (TRNC) include comparably much lower villa prices and also lower seafront apartment prices. In addition, there are also tax and banking benefits buying in a non-EU country. Our professional NCI advisors will be happy to explain the main differences to you during a no obligation initial telephone consultation.

HOW NORTH CYPRUS INTERNATIONAL CAN HELP

North Cyprus International (NCI) has 20 years’ experience at going the extra mile to match British and other overseas property owners with the right property.

Unlike some of the newer TRNC estate agencies, our British team can offer

- 20 years’ experience to ensure your purchase is hassle free

- Comprehensive relocation advice by our experts

- Offices in the UK and North Cyprus.

- All our properties legally vetted to ensure paperwork is in order

- Handholding after sales service to help you with your move.

YOUR FIRST PROPERTY VISIT TO NORTH CYPRUS

If you have never been to Northern Cyprus before – don’t panic! Our friendly team will talk you through the process of flights, taxi and hotels. We can advise on accommodation; car hire if required and much more.

There are international flights to Cyprus from almost all major British and European airports to both South Cyprus (Larnaca) and North Cyprus (Ercan via Turkiye). If you are viewing solely with our company North Cyprus International, we can help you arrange an inspection visit, providing courtesy airport transfers and a comprehensive 3-day introduction to the country and properties.

You can also choose to have a holiday first to get to know the country. In which case we will be happy to advise on how to book the best holiday. We can then arrange a no obligation half day property viewing experience as part of your holiday.

NO OBLIGATION TELEPHONE CONSULTATION

For a completely risk-free telephone chat with no obligation, why not contact us via email (help@northcyprusinternational.com), or message/call us in the UK or Cyprus on WhatsApp +44 7799 212425 or +90 548 861 0600.

21st January 2025